Morocco — Europe's next investment opportunity

Morocco is usually associated with its stable and predictable business environment compared to its regional peers.

It ranks first in the World Bank's political stability index for North Africa and it has a promising economic framework too.

Morocco is the first North African country in the World Economic Forum's Global Competitiveness Report, and it ranks third in the World Bank's ease of doing business ranking for the broader MENA region.

Years of stability and development have also brought new opportunities because, in the background, Morocco has long been developing its green energy and agriculture along with key infrastructure linking it to global markets.

Its location, stable business environment and green credentials make it a prime destination for European investors looking for opportunities in a place close to home and connected to the major Atlantic and Mediterranean trade routes.

And now, more than at any other time, there is a great reason to be optimistic that Morocco will fulfil its role as a natural connection hub between Europe and Africa.

The cornerstone of investment in modern Morocco

In 2020, amidst the COVID-19 pandemic, Morocco's government launched a strategic sovereign fund to aid the country's recovery: Mohammed VI Investment Fund (FMVII). The fund wants to play a leading role in investment and in boosting the local economy. As Morocco's economy experienced robust growth, the fund came to support major infrastructure projects that underpin our modern, industrial production base.

The Mohammed VI Investment Fund will accelerate the pace of investment, promote private-sector action and boost economic growth and job creation. But perhaps most importantly, the cornerstone of the fund's mission will be to usher in Morocco the economy of tomorrow. Green, digital and robust, the Fund will guarantee inclusive and sustainable growth for citizens in Morocco and their partners in Europe and Africa.

The green energy of tomorrow

With climate challenges over the horizon, Europe and Morocco must look towards new and clean ways of powering their economies. The European Commission identified hydrogen as a leading energy source for its future energy mix. The efforts required to retool the European economy and help it transition towards hydrogen will be substantial.

This is why a series of programs and even a hydrogen bank will be set up to help stakeholders during the transition. Morocco is firmly committed to becoming one of the primary exporters of green hydrogen to Europe. It is among the 30 pioneer countries to develop a hydrogen strategy and, according to the International Renewable Energy Agency, it is poised to become a global hub for green hydrogen production by 2050 when it will rank in the top five global producers.

However, the right financing needs to be in place. The Mohammed VI Fund will be a program firmly committed to financing green and ethical projects.

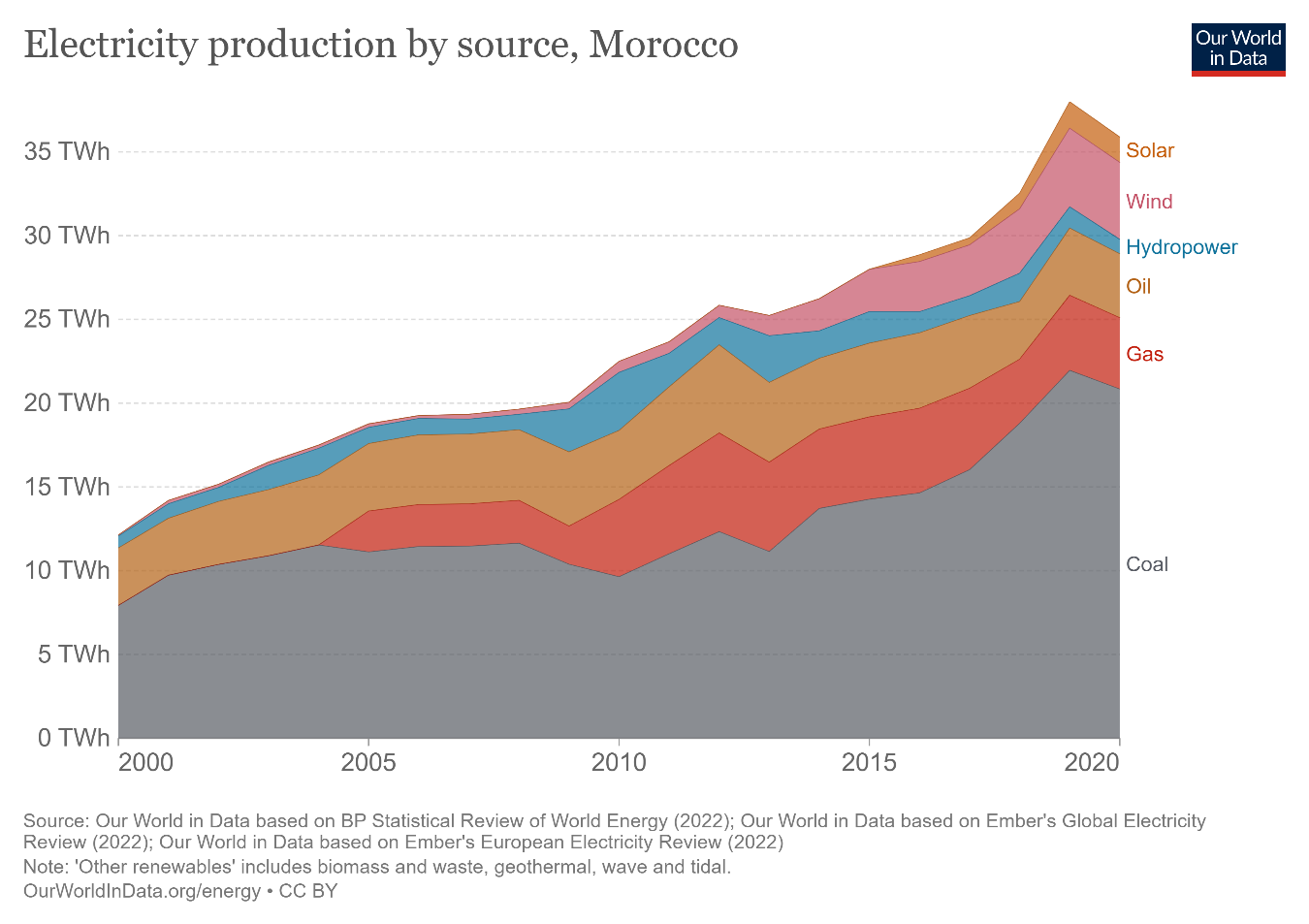

And we have a good track record of efficiently delivering green energy projects as remarkable improvements have been made in the environment field in the past two decades.

Appropriate policies have been designed to help the country take advantage of its remarkable geographic advantages in a sustainable way. Morocco has about 3,000 km of coast and high sun exposure facilitating abundant production of wind and solar energy. Renewables now represent 37 percent of Morocco's energy production capacity in 2020, with a 2030 target of 52 percent.

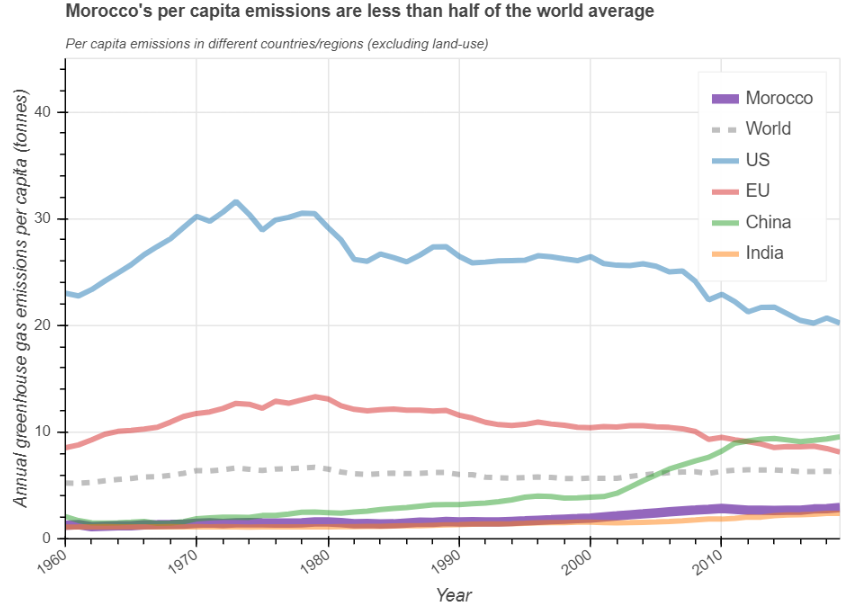

Its policies and pledges are close to being in line with the target of limiting global temperature rise to 1.5C. Among them, the government reduced fossil fuel subsidies from $6.5bn [€5.92bn] in 2012 to $1.1bn in 2016, completely phasing out the ones on petrol and fuel oil. All these have pushed Rabat to achieve the fifth position in the Country Climate Performance Index 2022.

Morocco has increased its electricity production from clean sources since 2000

Morocco has increased its electricity production from clean sources since 2000

This creates further opportunities for Morocco to contribute to Europe's renewable energy mix. Companies from Israel, the UK and the US are already seizing them. A clear example is the Xlinks Morocco-UK Power Project, an electricity generation facility entirely powered by solar and wind energy located in Guelmim Oued Noun, which is set to satisfy 10 percent of the UK's power needs via direct link by sub-sea cables.

In July 2022, the US launched a feasibility study for the construction of smart grid in Marrakech, which could serve as a model for other cities in the country. The project aims at minimising outages and increasing the presence of renewable energy across the network. It is also part of the Administration's plan to connect US industry to clean energy infrastructure projects in emerging markets. In August 2022, two Israeli companies signed a cooperation agreement with Rabat for new solar and wind power projects. Europe too must be present here.

With studies showing that the Sahara could satisfy 10 percent of European energy needs through renewables, political and business leaders can build on this. The regulatory framework is already in place to do so.

The EU and Morocco signed the first ever Green Partnership which supports the production and adoption of renewable energy by industries and consumers on both sides of the Mediterranean.

This can be built on a programme launched by the European Bank for Reconstruction and Development in 2015, providing a €110m facility for sustainable energy in Morocco.

Actively engaging with the country's private sector, this initiative is unlocking investments to create a green and competitive economy. The impact on the local economy is already clear. Studies show that Morocco's renewable energy sector could generate between 267,000 and 482,000 jobs by 2040, thus proofing the region against future shocks.

BBC graphic from PRIMAP-hist national historical emissions time series and the World Bank

BBC graphic from PRIMAP-hist national historical emissions time series and the World Bank

Looking towards the future

By way of final remarks, I would like to draw a comparison between my country and the economic success story that is Singapore. It all started with the little city-state offering the kinds of facilities to foreign investors that turned it into an economic hub that opened Asia to the rest of the world.

According to a 2022 UN report on the prospects of the global population, the African continent will experience an unprecedented growth in population and by 2050 25 percent of the world's population will be in Africa.

Not only that but we are in the beginning phase of creating our own single market, the African Continental Free Trade Area (AfCFTA), modelled on that of the EU. The Mohammed VI Sovereign Fund's ambition is to help make Morocco a vital piece of this huge market and to help translate this potential into shared prosperity for all.

Disclaimer

This article is sponsored by a third party. All opinions in this article reflect the views of the author and not of EUobserver.Author Bio

Mohamed Benchaâboun is the CEO of the Mohammed VI Investment Fund. He has held a series of banking executive positions in Morocco, including CEO of the Banque Centrale Populaire between 2008 and 2018. He also served as the Moroccan minister of the economy, finance and administration reform between 2018 and 2021. He also served as the ambassador of Morocco to France between 2021 and 2023.

Tags

Author Bio

Mohamed Benchaâboun is the CEO of the Mohammed VI Investment Fund. He has held a series of banking executive positions in Morocco, including CEO of the Banque Centrale Populaire between 2008 and 2018. He also served as the Moroccan minister of the economy, finance and administration reform between 2018 and 2021. He also served as the ambassador of Morocco to France between 2021 and 2023.